By EveryTicker Research | Published on December 11, 2025

Rezolve AI plc is a London-based developer of commerce-specific AI solutions leveraging its proprietary large language model, BRAiNPOWA, optimized for retail sales and customer engagement. It offers conversational commerce products through partnerships with Microsoft (TICKER:MSFT) and Google (TICKER:GOOGL), targeting global enterprise retail clients with a vertical AI SaaS model.

Executive Summary / Key Takeaways

- First-mover in agentic commerce with hyperscaler tailwinds: Rezolve AI has developed a proprietary commerce-specific LLM, BRAiNPOWA, and secured partnerships with Microsoft (MSFT) and Google (GOOGL) that provide access to approximately 90% of enterprise retail customers, creating a distribution advantage that would take years for competitors to replicate.

- Explosive revenue trajectory from near-zero to $100M ARR: The company grew from $188,000 in 2024 revenue to $70 million in annual recurring revenue by June 2025, targeting $100 million by year-end—a growth rate that validates market demand but raises execution risks as the organization scales rapidly.

- Path to profitability is materializing but cash burn remains critical: Management improved the break-even target to $90 million ARR (from $100 million), with gross margins around 95%, yet the company burned $2.2 million monthly in Q1 2025 with only $18.9 million in cash, creating a narrow runway that demands flawless execution.

- Roll-up acquisition strategy accelerates enterprise adoption but dilutes equity: The $55 million GroupBy acquisition and subsequent CrownPeak deal demonstrate a “roll-up strategy” that quickly yielded a $10 million annual contract with Liverpool Mexico, yet these equity-funded deals increase share count while the company explicitly avoids using cash to preserve operating runway.

- Key risk is execution at scale amid big tech competition: While Rezolve’s vertical LLM approach differentiates it from horizontal AI platforms, the company faces indirect competition from cloud giants (Amazon (AMZN), Microsoft, Google) that could erode its market position, and short-seller allegations (Fuzzy Panda) questioning revenue quality create overhang until proven false through sustained performance.

Setting the Scene: The Agentic Commerce Revolution

Rezolve AI plc, founded in 2016 in London and publicly listed on NASDAQ in August 2024, occupies a unique position at the intersection of artificial intelligence and digital commerce. The company addresses a structural problem in the $30 trillion global retail sector: while seven out of ten customers complete purchases in physical stores, the inverse is true online, where seven out of ten abandon their carts. This 70% digital attrition rate represents a massive economic inefficiency that traditional e-commerce tools have failed to solve.

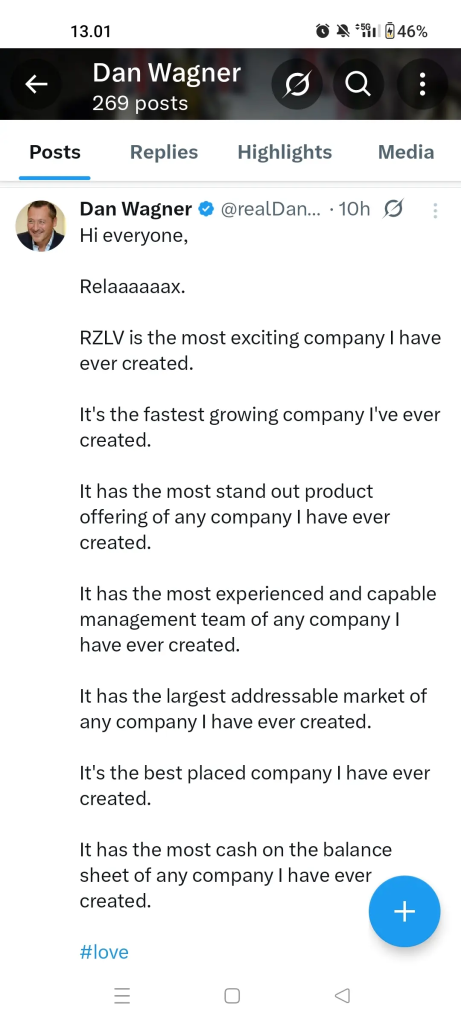

The company’s founder, Daniel Wagner, brings deep domain expertise from building pre-internet commerce platforms that operated in 192 countries and licensing search technology to IBM (IBM), Microsoft, and Fujitsu (FJTSY) before selling to Thomson Reuters (TRI) in 1999. This background explains Rezolve’s strategic focus: rather than building a general-purpose AI, the company developed BRAiNPOWA, a proprietary large language model trained on over 300 billion tokens and optimized for 30 billion parameters specifically for commerce applications. This vertical specialization is the core differentiator—while horizontal LLMs can converse about anything, BRAiNPOWA is engineered to be “the best salesperson on the planet,” with deep product catalog knowledge, empathy-driven prompt analysis (patented), and trained sales closing techniques.

Rezolve’s go-to-market strategy reflects this enterprise focus. The company leverages three channels: direct sales, strategic partnerships, and acquisitions. The second half of 2024 marked a pivotal inflection point when Rezolve secured multi-year partnerships with Microsoft and Google, making its Brain Suite available on Azure Marketplace and Google Cloud Platform. These partnerships provide access to approximately 90% of enterprise retail customers and include powerful incentives: cloud customers can credit Rezolve subscription spend against their cloud commitments, and sales agents can attribute Rezolve subscriptions to their quotas. This “double incentive” structure accelerates adoption in ways that direct sales alone cannot achieve, effectively turning the hyperscalers’ massive sales forces into Rezolve’s channel partners.

Technology and Strategic Differentiation: The Vertical LLM Moat

Rezolve’s product suite—Brain Commerce (conversational commerce in 96 languages), Brain Checkout (fast checkout with geolocation triggers), and Brain Assistant (after-sales support)—sits atop the BRAiNPOWA foundation. This architecture matters because it solves a critical technical challenge: AI hallucination in product catalogs. The company has patented processes for structuring product data that prevent the “drift” that plagues generic LLMs when they encounter specific SKUs, pricing, and inventory data. Google and Microsoft have recognized this advantage, which is why they partnered rather than built competing solutions.

The empathetic prompt analysis system is particularly significant. Unlike chatbots that simply match keywords, BRAiNPOWA understands customer intent and emotional state, enabling it to replicate the nuanced interactions of a skilled retail associate. This drives measurable commercial improvements for partners: stronger conversion rates, higher average order values, and increased omnichannel adoption like Click and Collect. The platform has already facilitated over $50 billion in gross merchandise value and more than 13.5 million transactions through April 2025, providing real-world validation that the technology works at scale.

Management’s R&D strategy focuses on deepening this moat rather than broadening horizontally. The company invests heavily in sales and marketing headcount (approximately 75% of employee costs) to drive enterprise adoption, while maintaining a flexible cost base that can scale with revenue. This suggests a capital-efficient model once break-even is achieved—unlike horizontal AI players that must continuously retrain on everything, Rezolve’s vertical model becomes more valuable as it accumulates domain-specific data, creating network effects within commerce that are difficult for competitors to replicate.

Financial Performance: Explosive Growth Meets Cash Reality

Rezolve’s financial trajectory tells a story of explosive growth from a standing start. The company generated just $188,000 in 2024 revenue, primarily from ancillary activities, while incurring a GAAP net loss of $172.6 million and negative operating cash flow of $21.6 million. This included $28.9 million in one-time non-cash DESPAC expenses , $44.3 million in debt extinguishment costs, and $25 million in share-based compensation—noise that obscured the underlying business momentum.AnnualQuarterlyRevenue (USD)Net Income (USD)

By the first quarter of 2025, the monthly cash burn rate had stabilized at approximately $2.2 million, driven by employee costs and professional services. The company held $18.9 million in cash while carrying $30 million in traditional bank loans and $6 million in remaining convertible debt expected to convert to equity. This liquidity position matters because it provides roughly eight months of runway at current burn rates, making the path to $90 million ARR and break-even not just an operational target but a financial imperative.AnnualQuarterlyOperating Cash Flow (USD)Free Cash Flow (USD)

The growth inflection is stark: first-half 2025 revenue reached $6.3 million, up 426% year-over-year, and annual recurring revenue surged to $70 million by June 2025. Management expects to surpass $100 million ARR by year-end, with the Liverpool Mexico deal alone contributing nearly $10 million annually—ten times the original $1 million per customer estimate. This deal size expansion, driven by the GroupBy acquisition and upsell of Brain Commerce with Google’s SEO Studio, validates the roll-up strategy’s revenue acceleration potential.AnnualQuarterly

Gross margins around 95% demonstrate the inherent scalability of the SaaS model, while the improved break-even target of $90 million ARR (versus the prior $100 million) reflects management’s confidence in cost flexibility. CFO Rich Burchill emphasized that cost growth is “highly elastic” and will increase in line with revenue, primarily through headcount additions in revenue-generating roles. This implies operating leverage will materialize quickly once the company crosses the break-even threshold, potentially driving significant margin expansion in 2026.

Competitive Context and Market Positioning

Rezolve competes in a landscape divided between horizontal AI platforms and specialized commerce tools. Direct competitors include Sprinklr (CXM), which offers broad customer experience management but lacks commerce-specific LLM capabilities; LivePerson (LPSN), whose conversational AI focuses on customer service rather than transaction completion; and SoundHound (SOUN), which specializes in voice AI but doesn’t address the full commerce funnel. Rezolve’s 426% growth rate in H1 2025 dramatically outpaces these peers, while its 95% gross margins exceed Sprinklr’s 68.7% and SoundHound’s 39.8%, reflecting the premium value of vertical specialization.

The more significant threat comes from indirect competitors: Amazon, Microsoft, and Google. Amazon CEO Andy Jassy’s declaration that “AI and agentic commerce” represent the “next great transformation in online shopping” validates Rezolve’s market timing but also signals Big Tech’s intentions. These giants can bundle AI commerce tools with existing cloud and marketplace services, creating convenience that could erode Rezolve’s market share. However, Rezolve’s partnerships with Microsoft and Google create a strategic paradox: it leverages their distribution while competing with their native capabilities. The implication is that while partnerships provide near-term distribution advantages, they create long-term dependency risk if the hyperscalers decide to prioritize their own solutions.

Rezolve’s competitive moat rests on three pillars: the proprietary BRAiNPOWA model’s commerce-specific training, patented anti-hallucination processes for product catalogs, and the empathetic sales engine. Management argues that horizontal LLMs suffer from “boiling the ocean”—trying to know everything rather than selling anything—while Rezolve’s vertical approach delivers measurable ROI. The Liverpool deal exemplifies this: GroupBy’s existing search relationship enabled an upsell to Brain Commerce at 10x the expected value, demonstrating that embedded relationships plus AI capabilities create pricing power that pure-play AI vendors cannot match.

Risks and Asymmetries: Execution at Scale

The most material risk is execution velocity. Rezolve must scale from $70 million to $100 million ARR while integrating GroupBy and CrownPeak, managing a $2.2 million monthly burn rate, and preserving its technology edge. The cash runway of approximately eight months creates a binary outcome: either the company achieves break-even by early 2026 or requires dilutive equity financing. Management’s explicit preference for equity-funded acquisitions—”we don’t want to use the valuable cash we’re using to fund our business”—acknowledges this constraint but increases share count pressure.

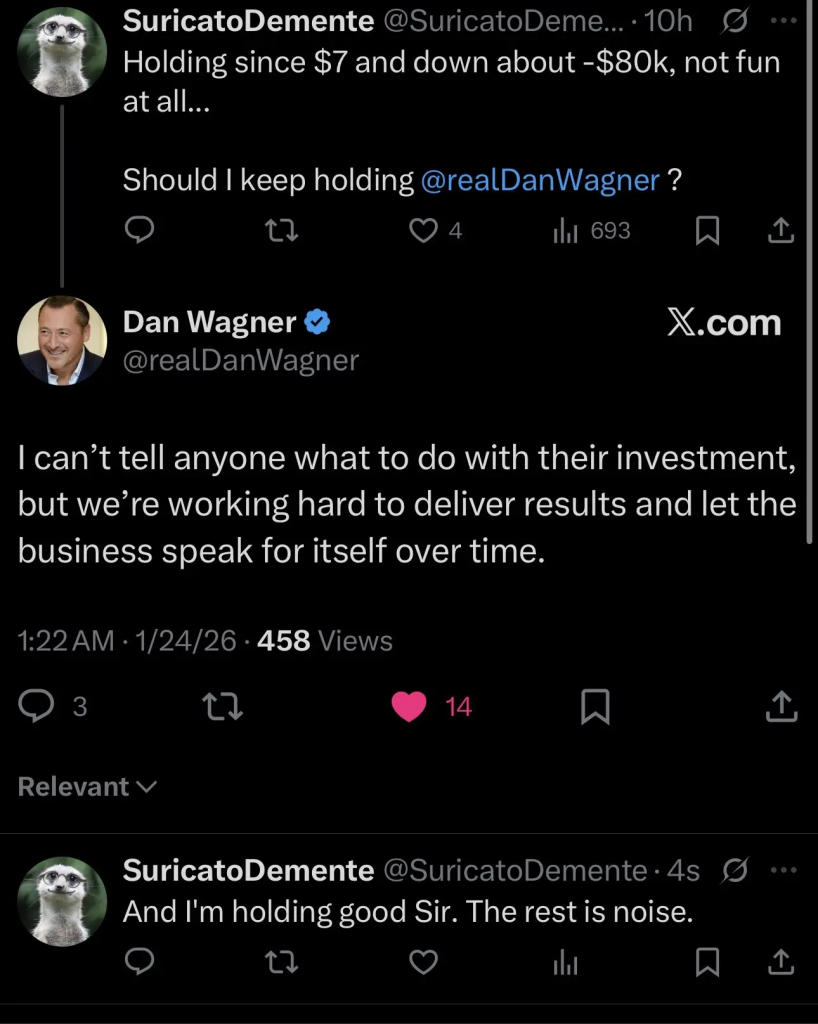

Short-seller allegations from Fuzzy Panda Research, which claimed Rezolve is “faking ARR growth by acquiring failing AI start-ups” and that 2024 revenue came from “soccer ticket sales, not AI,” represent a significant reputational risk. Rezolve categorically rejected these claims as “misleading and inaccurate,” noting Fuzzy Panda’s disclosed short position. Such allegations can depress valuation and create financing headwinds, even if false. The company’s response—pointing to audited financials, SEC filings, and real operations—will only be validated by sustained organic growth that outpaces acquisition contributions.

Competitive risk intensifies as Big Tech accelerates agentic commerce initiatives. Amazon’s Rufus shopping assistant, Google’s Gemini for retail, and Microsoft’s Copilot for commerce could commoditize the capabilities Rezolve is building. The company’s saving grace is its patented product catalog structuring, which prevents hallucination—a problem that has plagued generic LLMs in commerce applications. If Rezolve can maintain this technical edge while scaling its enterprise sales force, it may carve out a defensible niche. If not, it risks becoming a feature that gets absorbed into hyperscaler platforms.

The roll-up strategy itself presents integration risk. GroupBy brought enterprise search capabilities and customer relationships, but merging cultures, product roadmaps, and sales processes can distract management and slow organic innovation. CrownPeak’s acquisition adds content management capabilities, further expanding the product suite but also increasing complexity. The thesis depends on these acquisitions delivering revenue synergies that exceed their dilution cost—a bet that the Liverpool deal suggests is plausible but not yet proven at scale.

Valuation Context: Pricing in Perfect Execution

At a market capitalization of $858.55 million and enterprise value of $884.25 million, Rezolve trades at approximately 12.6x its June 2025 ARR of $70 million. This multiple sits between slower-growing Sprinklr (2.36x sales) and high-growth SoundHound (34.05x sales), reflecting the market’s attempt to price a company transitioning from startup to scale-up. This multiple embeds expectations of flawless execution: achieving $100 million ARR by year-end, reaching break-even at $90 million ARR, and maintaining 95% gross margins while scaling operations.

The company’s balance sheet shows $18.9 million in cash against $30 million in bank debt, resulting in net debt of approximately $11 million. This modest leverage is manageable, but the negative operating cash flow of $21.6 million in 2024 and $9.9 million in the latest quarter highlight the urgency of reaching profitability. The remaining $6 million in convertible debt expected to convert to equity in 2025 will provide some balance sheet relief but at the cost of dilution.

Comparing unit economics, Rezolve’s 95% gross margin significantly exceeds direct competitors (Sprinklr at 68.7%, LivePerson at 66.6%, SoundHound at 39.8%), suggesting that if the company can achieve scale, its profitability potential is superior. However, the operating margin of -513% reflects massive upfront investment in R&D and sales infrastructure. Investors must believe that these costs will leverage dramatically post-break-even, similar to how Salesforce (CRM) and ServiceNow (NOW) achieved margin expansion after crossing critical revenue thresholds.AnnualQuarterlyGross Profit MarginOperating Profit Margin

The valuation leaves no room for error. At 12.6x ARR, the stock prices in achievement of the $100 million ARR target and successful integration of acquisitions. Any slowdown in growth, increase in cash burn, or competitive pressure from Big Tech could compress the multiple toward Sprinklr’s 2.36x, implying 80% downside. Conversely, if Rezolve demonstrates consistent organic growth above 200% while expanding margins, the multiple could expand toward SoundHound’s 34x, suggesting 170% upside. This asymmetry makes the stock a high-conviction bet on execution rather than a value play.

Conclusion: A High-Stakes Bet on Agentic Commerce Leadership

Rezolve AI has positioned itself as a first-mover in the agentic commerce revolution, with a vertically-integrated AI platform that addresses a $30 trillion market’s core inefficiency. The company’s trajectory from $188,000 to $70 million ARR in 18 months, driven by strategic partnerships with Microsoft and Google and a roll-up acquisition strategy, validates both the technology and the go-to-market approach. The improved break-even target of $90 million ARR and industry-leading 95% gross margins suggest a clear path to profitability—if execution remains flawless.

The central thesis hinges on whether Rezolve can outrun its cash burn while fending off Big Tech competition. The eight-month cash runway creates urgency, but the hyperscaler partnerships provide a distribution advantage that pure-play competitors cannot match. The Liverpool deal proves that acquisition integration can deliver 10x upsell opportunities, yet the Fuzzy Panda allegations remind investors that rapid growth through M&A invites skepticism that only sustained organic performance can dispel.

For investors, the critical variables are partnership execution velocity, cash management discipline, and competitive response from Amazon and Google. If Rezolve can cross $100 million ARR by year-end while maintaining its technical edge and reducing cash burn, the stock’s 12.6x ARR multiple could expand dramatically as profitability becomes visible. If execution falters, the combination of high burn, equity dilution, and Big Tech encroachment could render the company a strategic acquisition target rather than a standalone winner. The story is compelling, but the margin for error is razor-thin.

Microsoft and Rezolve AI partner to drive global retail innovation with AI-powered commerce solutions

• Rezolve AI’s Brain Suite to be distributed via Microsoft Azure Marketplace with extensive go-to-market and co-sell support

• Companies collaborate to bring differentiated generative AI solutions to customers

REDMOND, Wash., and NEW YORK – Oct. 3, 2024 – Microsoft Corp. (NASDAQ: MSFT) and Rezolve AI (NASDAQ: RZLV), a global leader in AI-powered commerce solutions, on Thursday announced a strategic partnership to empower retailers with advanced capabilities for digital engagement. Through this collaboration, Rezolve AI’s Brain Suite – including Brain Commerce, Brain Checkout, and Brain Assistant – will be powered by Microsoft Azure and available globally via Microsoft’s Azure Marketplace and co-sell channels.

This partnership aims to empower retailers to transform their customer engagement and operations with advanced AI solutions powered by the Microsoft Cloud. In addition, Microsoft will extend extensive Go-to-Market (GTM) and co-sell support, providing marketing, sales, and technical support to accelerate Rezolve AI’s market penetration over the next five years.Click here to load media

“The potential for Generative AI to transform retailers’ businesses is immense,” said Nick Parker, President of Industry & Partnerships at Microsoft. “Through this partnership, we will combine the power of the Microsoft Cloud with Rezolve’s purpose-built solutions built on its unique Gen AI models, to bring a differentiated conversational AI experience to our mutual customers. Together, we can provide retailers with the tools they need to personalize shopping experiences and streamline operations at scale.”

“Partnering with Microsoft is an exciting opportunity,” said Daniel M. Wagner, CEO of Rezolve AI. “Its global reach and advanced Azure infrastructure combined with our Brain Suite create a powerful synergy that will revolutionize retail and commerce. Together, we’re making iteasier for retailers to harness the power of AI to boost engagement, streamline processes, and drive growth.”

Empowering Retailers with Scalable AI Solutions that address Friction in eCommerce and Digital Channels

Retailers today face significant challenges with their ecommerce solutions, including managing complex customer journeys, ensuring seamless checkout processes, and integrating AI-driven insights to enhance customer engagement and boost conversions. Rezolve AI’s Brain Suite, featuring Brain Commerce, Brain Checkout, and Brain Assistant, addresses these issues by providing intelligent, integrated solutions that streamline operations, personalize customer interactions, and drive sales growth.

Key Aspects of the Partnership:

- Levelling Up Digital and Commerce Engagement: By integrating the Brain Suite with Microsoft Azure, Rezolve AI offers retailers scalable and secure AI capabilities, backed by Azure’s enterprise-grade infrastructure, designed to reduce cart abandonment. For example, Brain Suite allows conversational engagement with digital and commerce channels in 95 languages, which can help retailers speed up the check-out flow as well as provide comprehensive generative AI-supported customer support. Additionally, Azure customers will benefit from pre-configured solutions that streamline deployment, offering rapid ROI and operational efficiencies.

- Global Distribution via Azure Marketplace: Rezolve AI’s Brain Suite will be listed on the Microsoft Azure Marketplace, providing seamless access for retailers globally to leverage AI-driven solutions for commerce.

- Extensive Go-to-Market and Co-Sell Support: The partnership will leverage co-sell and marketing support across five years, including:

- Marketing: Joint marketing campaigns, PR, and field enablement.

- Co-Sell Support: Access to Microsoft’s 35,000 incentivized sellers and marketplace rewards to accelerate customer acquisition.

- ISV Success Benefits: Access to Microsoft AI Cloud Partner Program benefits, unlocking incentives, co-sell readiness and technical support.

- Industry Leadership in AI and Retail: The partnership further strengthens Microsoft’s leadership in Generative AI solutions for retail, enabling retailers to stay competitive by adopting cutting-edge AI tools that personalize customer experiences and improve business outcomes.

On Jan 20 2026, Rezolve AI announced a $250 million registered direct offering — selling 62.5 million new shares at $4.00 each to institutional investors. This is essentially the company issuing a large block of new shares to raise capital for growth, sales expansion, potential acquisitions, and general corporate needs.

Why this hit the stock so hard:

- The offering was priced at a discount to the recent closing price — meaning new shares were sold cheaper than existing holders could sell theirs. Investors view that as dilution, which reduces existing shareholders’ ownership stake.

- Even though the capital raise strengthens the balance sheet, short-term selling pressure mounted as traders sold into the news, especially given RZLV’s already volatile price history.

📊 Market Reaction

The stock fell significantly (20%+ in some reports) on the day of the announcement as the news hit the market — a classic reaction when a small-cap or growth stock issues a large new share block.

📌 Context Matters

RZLV’s price behavior in January was already fragile:

- The stock had rallied earlier on ambitious revenue guidance for 2025–2026, which brought volatility.

- Shares are often viewed as speculative due to lack of profitability and heavy dilution risk, which makes investors sensitive to capital raises.

🧠 So Why Exactly Did It Drop?

In simple terms:

Investors sold because Rezolve AI announced a large share issuance at a discount, increasing dilution risk. Even though the company stated it needs the capital to grow, the immediate effect is downward pressure on the share price. This is a well-known market reaction for small/mid-cap tech stocks that rely on equity raises.

🧐 What This Means Going Forward

Neutral/Positive aspects:

- The company now has more cash to invest in sales, growth, and potential acquisitions.

Risk/Reassurance aspects:

- Dilution from new share issuances can keep selling pressure on the stock.

- Investors tend to be cautious with companies still far from profitability, making news like this a trigger for short-term drops.

1️⃣ What dilution actually changed (baseline)

Before offering

- Shares outstanding: ~336.3M

After offering

- New shares issued: 62.5M

- New total shares: ~398.8M

👉 Dilution = ~18.6%

That means:

- Whatever value you thought RZLV had before, the company now needs to be ~19% more valuable just to keep the stock price where it was.

2️⃣ Market cap math (this is the key part)

Let’s compare pre-drop vs post-drop scenarios.

Scenario A: Stock at $4.25 (pre-drop area)

- Market cap = 398.8M × $4.25

- ≈ $1.69B

So for RZLV to deserve $4.25 again:

➡️ The business needs to justify ~$1.7B valuation.

Scenario B: Stock at $3.40 (post-drop-ish)

- Market cap = 398.8M × $3.40

- ≈ $1.36B

That’s what the market is roughly saying now:

“We like the growth story, but we’re discounting execution + dilution risk.”

3️⃣ Does management’s guidance support that valuation?

Management has guided to roughly:

- ~$350M revenue in 2026

- ~$500M ARR exit-2026

Let’s apply reasonable SaaS / AI multiples (not hype ones):

Conservative multiple (3× revenue)

- 3 × $350M = $1.05B

Mid multiple (4× revenue)

- 4 × $350M = $1.4B

Optimistic multiple (5× revenue)

- 5 × $350M = $1.75B

📌 Translation:

- At $3.40, RZLV is priced roughly at a 4× forward revenue multiple

- At $4.25, it needs the market to believe execution will be clean and growth sticks

4️⃣ Why the stock dumped now (psychology piece)

Even if long-term math works:

- Traders hate discounted offerings

- Algorithms auto-sell on dilution

- Small/mid caps almost always overshoot to the downside

This was a mechanical sell-off, not a thesis-breaking event.

5️⃣ Decision framework (brutally honest)

👍 RZLV makes sense IF:

- You’re long-term (12–24 months)

- You believe they can actually hit $350M+ revenue

- You’re okay with volatility + possible more dilution later

- Position size is small/moderate

⚠️ Be careful IF:

- You’re trading short-term

- You expect smooth price action

- You don’t want more equity raises (this is still a growth-stage company)

6️⃣ Smart ways people play this setup

Not advice — just common approaches:

- Scale in (e.g. 25% now, 25% on weakness, 50% after execution proof)

- Event-based hold (stay through earnings / ARR updates)

- Risk-boxed trade (define max loss upfront)

Bottom line (plain English)

RZLV didn’t drop because the story broke.

It dropped because the cap table changed overnight.

From here, returns depend almost entirely on execution, not hype.

InvestorWisdom

Jan 15, 2026 4:02 AM

i’ve seen small companies do deals with Microsoft but unless it’s significant, i dont think Microsoft usually releases a PR themselves. It’s usually just the small company announcing it, with MSFT approval…

bluebird23

That $209 million ARR (Annual Recurring Revenue) they reported exiting 2025 is the “silver bullet” for their cash burn problem.

When a company has that much contracted revenue, the math starts to work in favor of the shareholders. Here is why that $209M figure is so critical when paired with Dan’s buying and the recent $250M raise:

1. Crossing the Profitability Threshold

Rezolve actually hit a major milestone last month (December 2025): their first profitable month. * They brought in over $17 million in revenue for that single month.. The 2026 “Moonshot”

Management has guided for $350 million in total revenue for 2026 and an exit rate of $500 million ARR.

If they hit $500M ARR by December 2026, they will be doing roughly $41.6 million a month.

At that scale, a software company with their margins (which they’ve claimed are in the 90% range) becomes a “cash cow” rather than a cash burner.

Jan 25, 2026 11:47 AM

The “Show Me” Phase

The next big catalyst will be the Q1 2026 earnings report. Investors will be looking to see if that $17M/month run rate stays steady or climbs toward the $25M mark. If it does, the “cash burn” conversation might disappear entirely.

1

V_T

Van

@V_T

Dan has been buying comfortably scooping up the weak hand’s shares😀. I bet he is not the only insider doing so. There was no pressure on them to report since the new rule starts on March 18th.

I am buying on Monday and I don’t care what the price is🥂

Bullish

Jan 25, 2026 5:27 AM

iVeee

Based on recent social media news, as speculation can easily spin out of control, this post is so we remain factual and informed. Since no filing explicitly details Dan’s buying, his post on X/Twitter remains an unverified claim. RZLV is a Foreign Private Issuer, he is not under the strict “2-day” deadline to file a Form 4, so there may be a lag—or he may be relying on the exemption to not file immediately. Without filing, investors have no “receipt” to verify his statement. Having said that, Dan acquired shares last year approx ~$3/share filed 13D to show receipt. It can also be done under 6-k. The “Processing” Lag: Under UK rules, there can be a gap of up to 6 business days (3 for him to tell the company + 3 for them to publish). If he bought recently, the paperwork might still be in the pipeline. That said, since he says he’s buying again ~$3s alludes to helping fight short attack, I personally TRUST him on his words and will act, before not after, the moment of truth.

Jan 25, 2026 8:06 AM

Ultrasuede

Evolution of The Mind

@Ultrasuede

Joined May 2020

For those who didn’t know, Dan and the team will be presenting and meeting with reps of some of the most prestigious brands in the world in Abu Dhabi, Starting tomorrow.

luxe.shoptalk.com/home

Bullish

Home Page

https://luxe.shoptalk.com

Jan 26, 2026 8:45 PM

iVeee

Disagree. Microsoft and Google doesn’t have all the products needed to make “agentic commerce” work. They rely on 3rd party providers, and together create the ecosyst. For example, geofencing. McDonalds rely on RZLV’s tech acquired from Bluedot, with Google as Cloud provider. Same goes for payment rails and blockchain data rail. Understand that there is only one company out there with blockchain data rail for online commerce, and that company is RezolveAI. A technology that many banks today have implemented into production due to its resilience and auditable ledger – you can follow ever cent transaction without getting hacked/fudged the data. This is currently missing on the online retail space but banks use it today. There is more to the partnership between rivals Microsoft and Google, partnering with the same company RezolveAI, which also deeply embedded partnership with Tether. But Rome wasn’t built in a day.

Feb 01, 2026 11:17 PM

garfield688

Yesterday 10:59 PM

RZLV strategy during 2025 was based on a strong belief that the partnerships with Google and Microsoft would bring lots of new customers, which would result in organic growth.

As far as we know, the partnerships didn’t bring many new customers, but still, were valuable to get RZLV into major events and get visibility.

Looking back, and with more insights from recent announcements, it’s easy to understand why the partnerships were not bringing new customers.

The partners (Google, Microsoft) were developing their own e-commerce agentic AI experiences natively integrated into their products.

So, Google and Microsoft would not send their customers to RZLV, because they were planning to offer similar products.

The partners became direct competitors.

https://blog.google/products/ads-commerce/agentic-commerce-ai-tools-protocol-retailers-platforms/

Microsoft propels retail forward with agentic AI capabilities that power intelligent automation for every retail function – Source

REDMOND, Wash. – Jan. 8, 2026 – Microsoft Corp. on Thursday announced agentic AI solutions designed to bring intelligent automation to every part of the retail business. These new capabilities help retailers move faster, serve shoppers with greater relevance, and operate with resilience and efficiency, delivering a modern foundation for growth in a highly competitive market.

https://news.microsoft.com/source/2026/01/08/microsoft-propels-retail-forward-with-agentic-ai-capabilities-that-power-intelligent-automation-for-every-retail-function/

https://www.reddit.com/user/UnhappyEye1101/

Palantir 2.0 but in WHOLE different sector.

Rezolve AI benefits from the “Unlikely Allies” trend by positioning its proprietary technology as the specialized commerce “brain” that powers these larger platforms.

While the chart shows tech giants like Google, Microsoft, and OpenAI partnering with Shopify and retailers to combat Amazon, Rezolve AI acts as a strategic “middleman” that integrates deeply into those larger platforms.

We talk about Agentic Commerce revolution that is already rolling but retail investors are not catching it yet.

RZLV technology will be integrated everywhere & without RZLV – tech future online shopping will feel like real fiasco.

RZLV will be big in the future & making it’s early steps NOW to become market leader in Agentic Commerce. This sector is predicted to be 3 – 5T in 2030. Potential is HUGE.

WE investors are still early in RZLV even though it’s early 2026.

I got first time in the stock February 2025 stock was trading 2 – 3$ share.

Where it trades now? Around same area, 2 – 3$’s.

What has been happening inside the company?

LOTS OF THINGS that share price is not showing for us.

Do you folks remember the Amazon – share price situation back in early 2000’s? From 113$ to around 6$ even though all the metrics in the company were showing things are improving.

Lots of great things has been happening & only minimal “bad things” if you are in the stock with long term vision.

One example: How markets are pricing RZLV currently after share offering? —> Markets are probably pricing in super shit earnings report or something worse. What RZLV – management is projecting for full year 2026? 350M revenue & 500M ARR.

https://rezolve.com/press-releases/rezolve-ai-guides-to-350-million-2026-revenue-and-500-million-arr-exit-run-rate/

Those are not baby numbers. Those are hyper growth numbers. Real BÄNGER – NUMBERS & markets are not yet believing what RZLV – management is projecting.

When markets make turnaround with RZLV & really believe what RZLV projects hold your horses & I really hope you’ve accumulated great long term position until that happens.

Think deeper & make deeper DD folks. We ain’t leaving. Remember: Timing the markets sucks BUT time in the markets is the key for success.

Agentic Commerce

For years, ecommerce has been built around a simple assumption. Shoppers browse websites, compare options, and decide for themselves.

That model is starting to change.

With the rise of AI shopping agents that can act on a shopper’s behalf, discovery and decision-making are increasingly being delegated.

Instead of clicking through dozens of product pages and forums, customers can describe what they need and let AI evaluate options and even complete purchases for them.

This shift has major implications for ecommerce businesses. When buying decisions are mediated by agents rather than humans, visibility and persuasion work differently.

What is agentic commerce?

Agentic commerce refers to shopping powered by AI agents. These agents act on behalf of consumers to evaluate options and complete purchases.

Instead of manually browsing websites, comparing products, and checking out themselves, shoppers define intent, preferences, and constraints. The agent then handles discovery, comparison, and transaction execution.

What makes this agentic is autonomy. The agent is not just assisting or recommending. It can make decisions and take action without requiring step-by-step approval.

How has agentic commerce changed shopping behavior?

Agentic commerce changes how people shop by reducing the amount of work they need to do themselves.

A typical ecommerce journey used to look like this:

The shopper searches for a product or browses a category

They click through multiple product pages

They compare features, prices, and reviews

They cross-check information across forums or external sites

They narrow down options and make a final decision

They complete checkout themselves

This process relies on human judgment at every step. Shoppers actively evaluate trade-offs and absorb large amounts of information before buying.

With agentic commerce, the flow changes:

The shopper describes what they need and sets constraints

An AI agent scans available options across sources

The agent filters products based on requirements

One or a small number of qualified options are surfaced

The agent completes the purchase or prepares it for approval

Why does agentic commerce matter to ecommerce businesses?

Agentic commerce is not just another change to ecommerce. It represents a structural shift in how businesses compete for discovery and conversion.

For years, ecommerce optimization has focused on influencing shoppers across a long, human-led funnel.

Each stage offered opportunities to shape perception, build confidence, and nudge shoppers toward conversion. Like this:

Awareness and discovery: Businesses invested in search rankings, paid ads, marketplaces, and social channels to capture attention early in the journey.

Consideration: Marketplace and product pages, descriptions, imagery, and reviews were the only ways to differentiate offerings and persuade shoppers as they explored options.

Evaluation: Detailed specifications, FAQs, and social proof supported human decision-making. Shoppers validated claims, compared trade-offs, and built confidence before committing.

Conversion: Checkout optimizations, promotions, and retargeting helped recover hesitation and push decisions over the line.

When agents take on more of the work of shopping, influence shifts earlier in the funnel and happens faster. Like this:

Awareness and discovery: Instead of browsing results, shoppers express intent directly to an agent. Products are surfaced based on relevance, fit, and availability, rather than visibility alone.

Consideration: Product data and content play a critical role in helping agents understand what a product is, who it’s for, and whether it meets the shopper’s needs. Clarity, completeness, and consistency matter more than surface-level persuasion.

Evaluation: Much of the evaluation is delegated to agents and happens upstream. Accurate attributes, clear specifications, and reliable information determine whether a product progresses or is filtered out before a shopper ever sees it.

Conversion: Once a product is selected, conversion can happen quickly, sometimes automatically. With fewer touch points, there are fewer opportunities to intervene late in the journey.

Across the funnel, the opportunity to influence decisions hasn’t disappeared. It has moved earlier, become more compressed, and increasingly depends on how well product information communicates intent, suitability, and confidence.

Conclusion

As ecommerce moves toward agent-led discovery and purchasing, product data becomes the deciding factor. It determines whether a product is understood, evaluated, and ultimately acted on by an agent.

At Hypotenuse AI, we’re seeing more brands invest in stronger product data foundations. Teams are using Hypotenuse AI to enrich product attributes, generate accurate product content, and keep catalogs aligned across channels at scale.

Agentic commerce doesn’t replace ecommerce fundamentals. It raises the bar on them. Brands that treat product data as a growth lever, not just an operational task, will be better positioned to stay visible, trusted, and chosen as shopping increasingly shifts toward delegation.

Future of Agentic Commerce: an Interview with Arthur Yao Deputy CEO of Rezolve AI

https://www.youtube.com/watch?v=_styKm4Whhs

20250408

They_Call_Me_Tater_Salad

Lots of comments still about Fuzzy 🐼. I have a different take.

The recent price action on RZLV is a masterclass in institutional manipulation and you just need to look at the anchor investors.

Alyeska and Citadel are the backbone of the company’s recent capital structure, and anchored two $250 million raises at $5 and $4 PPS.

”Why would they short a stock where they have $500M on the line at a higher price?”, you ask?

Control.

By temporarily suppressing the price, they create an environment where they can vacuum up more shares from retail at $2.20 – $3.00. This lowers their total cost before the stock takes its next leg up.

They can’t just “buy” 50 million shares without the price hitting $20 instantly. They need retail to panic. They need stop-losses to trigger to create the “sell-side liquidity” required to fill their massive buy orders.

They are flushing weak hands to ensure that when the actual catalysts hit (like the 2026 revenue guidance or M&A news) they own the float.

Feb 04, 2026 4:23 AM

————

DVD22

4:37 AM

@They_Call_Me_Tater_Salad

Interesting angle. I’d frame it less as manipulation and more as institutional patience vs retail emotion.

They anchored $500M at $4-5 for a reason. If the thesis still holds, they’re likely adding quietly while retail sells. No complex scheme needed just experience.

The real question is does the 2026 revenue story still make sense? If yes, current price could be opportunity. If no, institutions got it wrong too.

Watching volume and price action into Q1 to see how this develops.”

Bullish

—————-

They_Call_Me_Tater_Salad

4:45 AM

@DVD22 My concern has always been organic growth. Honestly, I don’t know if they have that yet. However, even as a solo investor I can get C-Suite 1 on 1s and I always come out knowing far more than when I went in. If I was giving you $250,000,000 you can be damned sure I will have a team meet with you and will know everything about everything. I’m investing here because I am betting that the diligence of those two anchor investors was sufficient to warrant a strong entry at a price point 42%+ below their recent average.

Bullish

————-

DVD22

4:55 AM

@They_Call_Me_Tater_Salad

Fair point on the organic growth question, that’s the key risk here.

But you’re right about the anchor diligence angle.

Alyeska and Citadel don’t write $250M checks without deep dives. They saw something.

I’m in a similar boat, betting their homework was solid and this dip is mispricing vs. what they know.

Time will tell if we’re right to piggyback on their conviction.

Care to share what you’ve learned from your c-suite convos that moved the needle for you? 😉

Bullish

———-

They_Call_Me_Tater_Salad

5:55 AM

@DVD22 Those aren’t related to RZLV specifically. Generally you go into those meetings with questions around topics that there is no public response to, and often that analysts avoid asking for some reason. If I was talking to Dan I would ask about organic vs inorganic growth numbers.

Inevitably the CEO or CFO will answer something like, ”Well we need to answer carefully, but lets just say we are extremely pleased with our organic numbers and they surpassed our expectations” or ”Our organic growth has not been as strong as we hoped.”

l’ve exited entire positions within minutes of meetings and also doubled down.

————

DVD22

6:15 AM

@They_Call_Me_Tater_Salad

Many thanks indeed for taking the time to share these insights, genuinely appreciated.

Your perspective on the value of direct engagement and reading between the lines in management commentary is particularly instructive. 🍻 Cheers!

Bullish

———–

erik1025

4:29 AM

@They_Call_Me_Tater_Salad Wagner cant mandate that they dont short? Or is it kind of understood that this is the way it goes?

Bullish

————–

They_Call_Me_Tater_Salad

4:37 AM

@erik1025 He can’t.

In a Registered Direct Offering (RDO) like the one RZLV just closed, the company enters into a “Securities Purchase Agreement”.

Through this Wagner and ACHV are usually restricted from issuing new shares for 30–60 days. Unlike an IPO, where insiders have a strict 180-day lock-up, the institutional buyers in these raises receive fully registered, freely tradable shares immediately or very shortly after closing.

It is extremely rare (almost unheard of) for a multi-billion dollar fund to sign a contract saying they cannot hedge or short. They view it as a violation of their fiduciary duty to their own clients to give up their right to manage risk.

Once the deal is closed and the shares are in their account, Rule 105 (which restricts shorting during a deal close period only) no longer applies. They can short the open market all they want to “hedge” their $4.50 entry or to engineer the “liquidity sweep” we discussed.